Big Question 4 - Why Is THR Important to BAT?

KEY SUMMARY POINTS

01

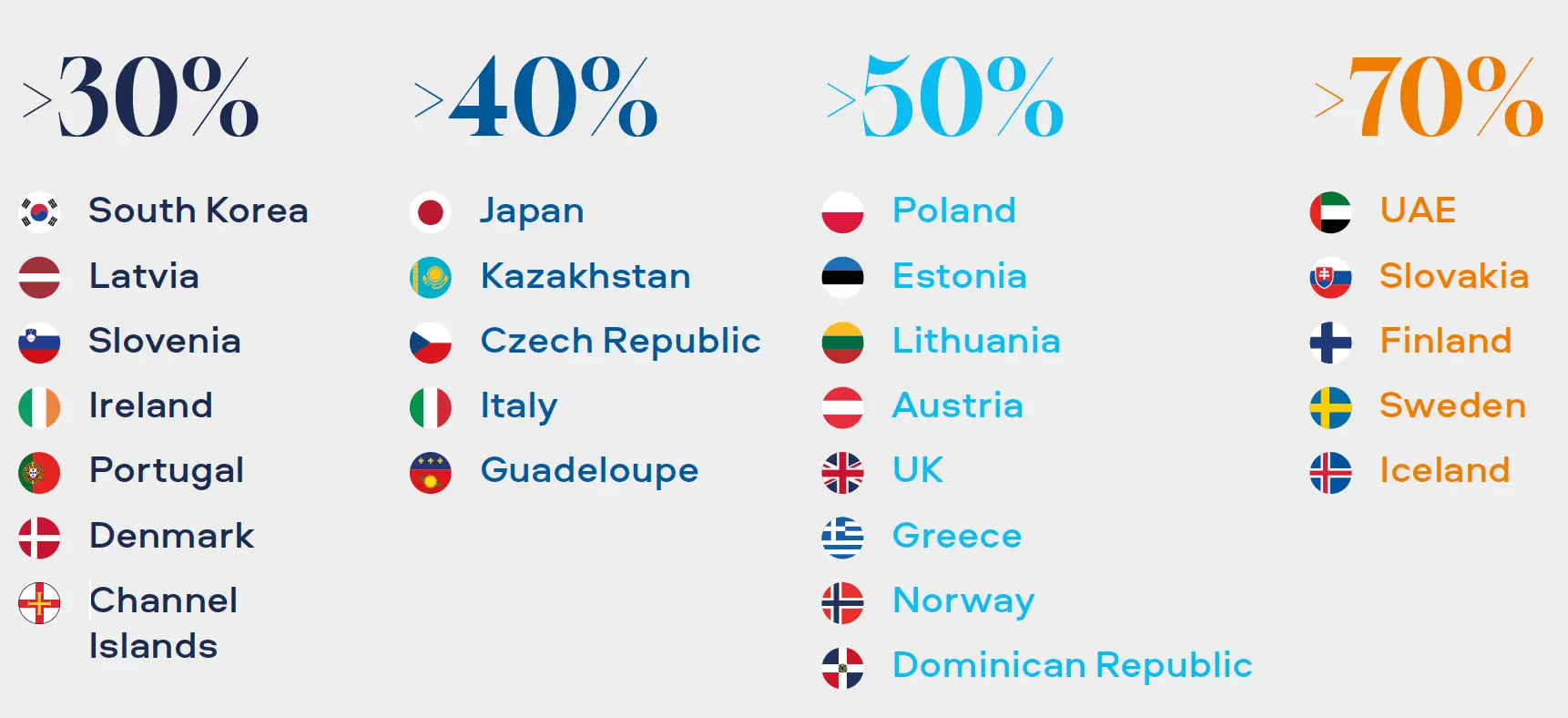

There are approximately 115 million adult consumers of Smokeless Products, with Vapour Products the biggest contributor.[1,2,3]

02

In 25 of our global markets we have >30% of our business in Smokeless Products.

03

Heated Products, Vapour Products, Oral Tobacco Products, and Oral Nicotine Pouches can deliver our commercially sustainable future.

"The tobacco and nicotine industry has undergone a seismic shift in recent years. Increasing numbers of adult smokers are migrating to Smokeless Products like Vapour Products, Heated Products, and Oral Nicotine Pouches. With an increasing amount of scientific research behind these products, they represent an opportunity for Tobacco Harm Reduction on a global scale."

Kingsley Wheaton

Chief Corporate Officer

THR is not only beneficial for public health, but a business opportunity for BAT. We aim to avoid mistakes of the type that led to the restructuring of Kodak, which once dominated the world market for consumer film and film processing. Kodak failed to appreciate that digital imaging would make film obsolete and did not evolve its business and product line accordingly.

“The downfall of such a titan was not just a business failure; it was emblematic of the perils that await companies that rest on their laurels. In the modern business landscape, where adaptability is king and innovation its queen, Kodak's story serves as a stark reminder. It underscores the significance of staying ahead of the curve, of recognising emerging trends, and of the dire consequences that can befall those who become complacent.”[4]

![Figure 1. Longitudinal growth of Smokeless Products (Total Adult Consumers, millions)[1,2,3] Longitudinal growth of Smokeless Products (Total Adult Consumers, millions)](/gb/en/chapters/chapter-2/big-question-4-why-is-thr-important-to-bat/_jcr_content/root/container/batcom_container_cop/batcom_columncontrol_300338747/col_1/batcom_image.coreimg.png/1746524241248/figure1.webp)